The concept of cashback is a growing trend amongst Australian consumers, with over a million Australians utilising cashback services. Find out what cashback is and how it could work for online businesses.

Cashback Landscape

Because of its rewarding nature, incentivised cashback affiliates have grown tremendously in the past few years. The impact of cost-of-living pressures has increased the popularity of cashback incentives, and it shows no signs of slowing down.

According to latest Ipsos iris data, over 11.2 million Australians used a retail loyalty website or app in May 2023, which is the highest recorded number of the year. Additionally, 58.7% of internet users worldwide stated that earning rewards or loyalty points was one of the most valued aspects of their retail shopping experience. This indicates that shoppers are becoming increasingly deal-sensitive.

Cashback sites are among the top-earning affiliate types within the affiliate and partnership industry. Companies who have participated in rewards such as cashback grew their revenue up to two and a half times faster than competitors who do not use them while generating 100-400% higher returns to their shareholders.

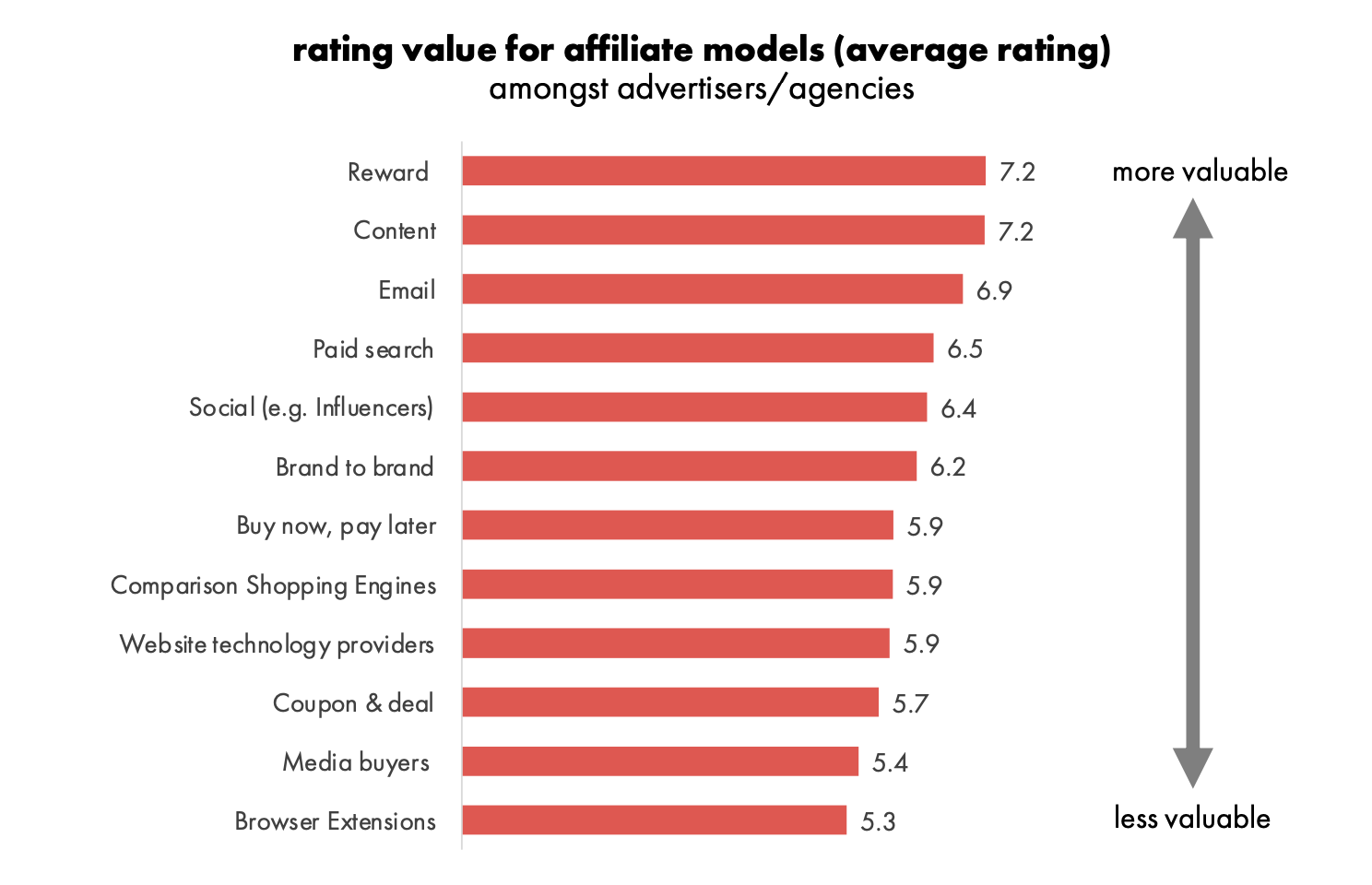

The global cashback industry is expected to be worth more than $200 billion a year by 2024, with statistics showing that 46% of cashback participants say it affects their spending habits. Additionally, advertisers highly value cashback and reward affiliates. According to the latest IAB Australia Industry survey, cashback credit card account rewards and loyalty programs ranked second out of the nine affiliate models reviewed:

Source: IAB Affiliate Marketing Australian Industry Review 2023

Getting Started

Here are answers to the most common questions asked by advertisers when evaluating cashback partnerships:

- What is cashback?

- How Does Cash Back Work?

- How can retailers work with cashback affiliates?

- What are some of the misconceptions about cashback?

- What are the benefits of cashback affiliates?

- What Are Some Cashback Strategies Retailers Can Explore?

- Can you work offline with cashback affiliates?

- How Can I Control How Much Commission and Cashback is Passed Back?

- How Do I Know the Sales Are Incremental to My Existing Pipeline?

What is Cashback?

A cashback website rewards customers by paying them a percentage of the money usually delivered to a retailer as commission on an online sale. Cashback reward programs are also sometimes utilised directly by advertisers to reward customers, offering them the chance to earn cash while increasing retail sales to offer cashback directly from the total amount paid by the consumer.

How Does Cashback Work?

While cashback might seem a little complicated, it can be broken down into a straightforward process:

- Search - While shopping online, the consumer finds the product they need from an advertiser on the cashback site.

- Redirect - The consumer clicks on the advertiser of their choice and is redirected to their website.

- Shop - The consumer purchases from the advertiser's website and receives a financial incentive in the form of cashback (for the percentage or fixed amount advertised) after the order is confirmed.

- Payment - Once the advertiser validates the transaction, the consumer receives their cash back into their member's account and can choose several redemption options, including cashing out the amount directly into their nominated bank account.

How Can Retailers Work with Cashback Affiliates?

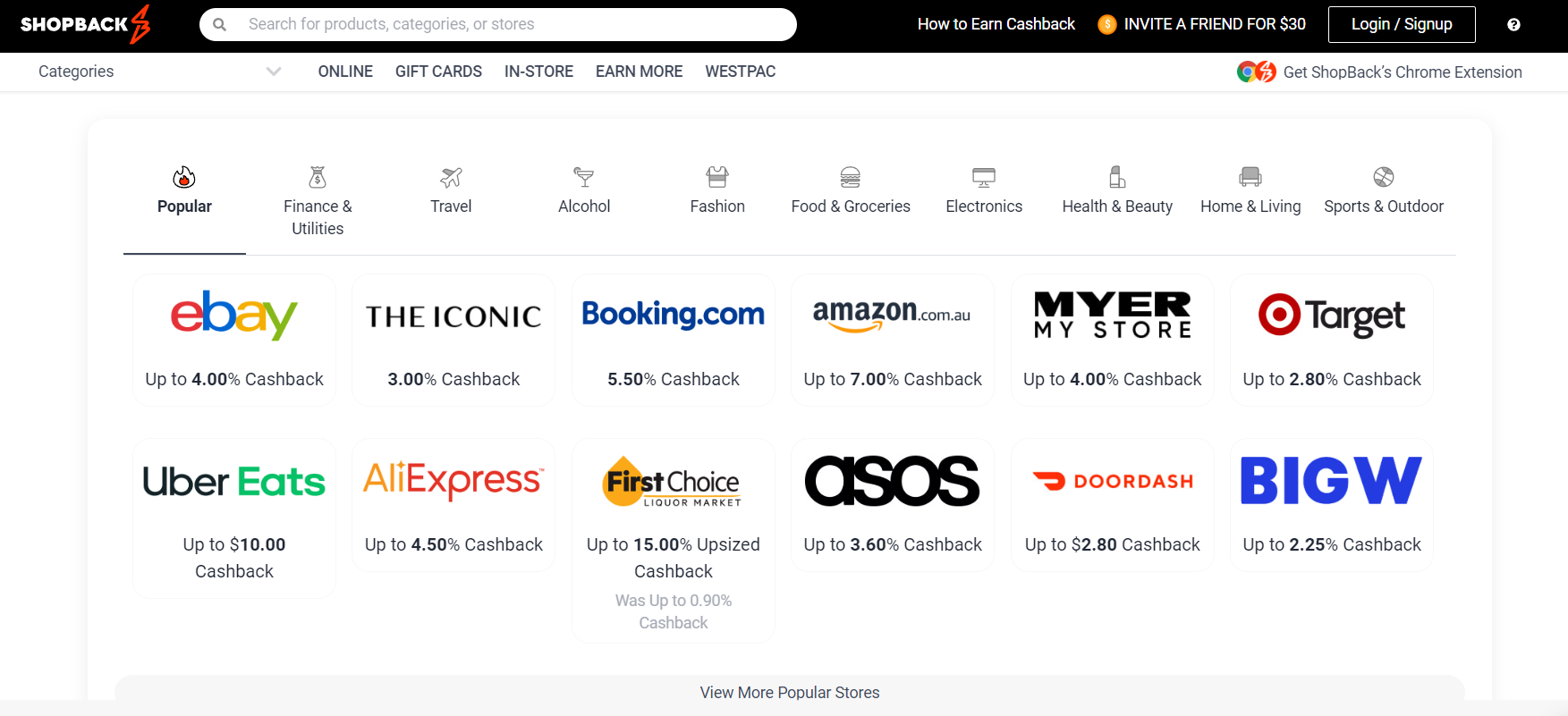

Source: https://www.shopback.com.au/

Retailers can easily optimise their affiliate program via a wide range of cashback sites. Here is how cashback works for retailers.

Once the advertiser accepts the cashback partner to their cashback programs - there are specific criteria a partner usually needs to meet - they will integrate the advertiser onto their site.

Once integrated, the advertiser will be active on the site for shoppers and large member bases to engage with. The advertiser is categorised depending on their product or service offering - such as fashion, travel, or telecommunications - so users can quickly and efficiently search for what they are looking for.

Businesses can also optimise with the cashback partner by negotiating a commission or pay increase for an agreed time frame in exchange for increased exposure. Once the cashback promotions are established, the advertiser will gain increased coverage and presence on the affiliate's traffic sources, likely increasing sales.

Integrating cashback promotions means that customers are eligible for even more money (in the form of cashback) when they make a purchase. Hence the more cash back after each transaction, the more attractive the advertiser may look to the consumer on the cashback site.

What Are Some of the Misconceptions About Cashback?

Here are some common myths and misconceptions an advertiser may have about cashback promotions and affiliates.

"Cashback sites don't add value to my affiliate program"

Cashback sites have a large and varied consumer reach. As such, they can help brands reach new customers - who can become long-term valuable customers.

For example, both ShopBack and Cashrewards have grown their user numbers drastically over the years. These cashback affiliates have over 1.5 million users in their database, which provides advertisers with innovative ways to target their customers where they shop. This, in turn, gives brands higher engagement and more exposure opportunities.

Cashback sites are also increasing their customer reach. Recently, Cashrewards has introduced its partnership with ANZ which exclusively targets ANZ customers - allowing advertisers to reach a specific pool of consumers. ShopBack has also recently partnered with Westpac which allows Westpac customers to link their debit or credit card and gain exclusive access to offers across many brands and higher Cashback opportunities.

Cashback sites also offer dedicated category campaigns and promotions across key and category events. This allows shoppers to be targeted for specific types of products, as well as assists with targeting new, returning, or lapsed customers.

"Cashback sites will devalue my brand"

Cashback sites engage with various consumer demographics, both on the high-end and price-sensitive spectrum. Publishers like Cashrewards have a pool of affluent shoppers who are willing to spend larger amounts, and many luxury brands have found this a great way to reach new customers as well as engage with loyal customers.

Additionally, cashback sites are not dependent on advertisers offering discounts or offers. Instead, consumers visit these sites for other reasons, such as content and user reviews.

"Cashback sites attract users that aren't valuable to my business"

The average cashback user is generally more tech-savvy and could be part of a higher-income demographic. This means they may have more money to spend on brands and promotions.

In addition, cashback users are loyal to the cashback concept or even a specific cashback site, meaning they will exclusively shop at brands that offer cashback. Therefore, brands that advertise on this site could target ready buyers already at the bottom of the marketing funnel.

ROAS and flash sales reservations

Advertisers may face common misconceptions about the value of flash sales and ROAS. For example:

"I don't think my ROAS will be high enough if I work with publisher X."

"I don't want to participate in a flash sale as I'll overspend."

"Flash sales may not work for my brand as well as other brands."

Flash sales are a great way to introduce consumers to your brand. Many consumers who have shopped through flash sales may reengage with that brand later - creating lifetime customer value.

Although they happen in a short period, flash sales provide your brand with exposure and brand awareness to a larger audience. By partnering with an affiliate network like Commission Factory, you are in control by selecting the best affiliate for your promotional strategy.

What Are the Benefits of Cashback Affiliates?

The cashback model benefits many retail businesses, including fashion, groceries, electronics, travel, department stores, liquor, and food delivery services.

The following are key benefits that advertisers may receive when partnering and collaborating with cashback sites:

Higher Average Order Value (AOV)

Many cashback website members may be incentivised to spend more to earn greater cashback, leading to an increase in the multi-product orders and higher AOV for advertisers.

Improved Conversion Rate

Members use cashback websites for one general reason - when they make purchases, they are rewarded with cash. Rather than pondering over making a purchase, members ensure they receive this cashback by converting.

Many cashback users already have purchase intent and are looking for that extra incentive. These users will choose to shop with an advertiser that provides the most value. In this way, purchases made via cashback promotions satisfy customers and advertisers alike.

Since their inception, cashback promotions have established a way to increase sales and reward the customer for their purchase without discounting products and devaluing a retailer's proposition. Hence, working with cashback means a win for businesses and buyers alike.

New Audience Reach

Some cashback sites have member bases of thousands or even millions of active users and continue to grow their user bases over time. These sites have the data and ability to run segmented campaigns to target new consumers, which simplifies the new customer acquisition challenge for advertisers.

Return on Ad Spend (ROAS) Targets

Cashback websites work on a CPA model, which means that they pay commissions only after a successful conversion for an advertiser. Advertisers can often book additional exposure by increasing the pay rate alone, which scales up the volume while maintaining positive ROAS.

What Are Some Cashback Strategies Retailers Can Explore?

When it comes to working closely and building a stronger relationship with cashback sites, the list below outlines the primary ways that an advertiser can optimise via cashback:

Increased Brand Exposure

Tactical CPA increases can create a buzz around a brand resulting in increased exposure across sites, including homepage or category pages, social media or EDM exposure.

Optimal Paid Placement

Cashback sites may offer some paid placement options to businesses, which are optional to participate in. These are premium placements that can include home page banners, dedicated email and more.

Placements are common during vital retail periods, and they are worth investing in because of the premium exposure guaranteed in return.

Flash Sales

Flash sales give consumers an extra jolt to act quickly and purchase when the cashback rate is at its highest, leading to a spike in sales. It refers to the advertiser assigning a higher commission rate to the cashback site for a shorter than usual time frame (typically 1-2 hours).

It can be a great way to control the budget as the exposure will run for a limited time. Flash sales are organised by the affiliate businesses and are pitched to the advertiser on a case-by-case basis.

Can You Work Offline With Cashback Affiliates?

A recent development in the world of cashback within the Australian market is implementing this reward via brick-and-mortar stores.

Advertisers with storefronts can utilise card-linked technology to incentivise members to make purchases in-store. In most cases, the member connects their credit card or bank account to their cashback account to be eligible for savings on purchases.

Once their purchase has been approved, the cashback amount will be transferred into their cashback account, which can then be withdrawn into their bank accounts.

This phenomenon has opened up much discussion regarding omnichannel optimisation and being able to utilise online marketing channels to increase in-store performance and change consumer spending habits in the brick-and-mortar environment.

How Can I Control How Much Commission and Cashback is Passed Back?

Advertisers can control the amount of commission they pay their affiliates. Custom commission rates can be scaled down to product margins and even a specific product level.

For example, a department store can assign a 2% commission to electronics, a 10% commission to children's toys and 8% commission to all fashion and apparel simultaneously. With the cashback, affiliate decides the commission percentage passed to the user.

How Do I Know the Sales Are Incremental to My Existing Pipeline?

This is dependent on how an individual advertiser views incremental sales. This could be a percentage of new customer sales, higher AOV or increased conversion rates.

The answer here is to:

- Ensure your program is set up to track and report all the most important incremental KPIs optimally

- Test and review.

One way to do this would be to look at performance metrics before partners have started promoting your brand and then measure performance against a like-for-like period after they are live.

Final Thoughts

Working with cashback sites is simple and effective, with no barriers to entry for the advertiser. All that is needed is an active affiliate program and to accept these affiliates to the advertiser's program. As more consumers adopt this method of shopping, it makes sense to trial this vertical.

With online retailing becoming more competitive, implementing cashback means gaining a competitive advantage and staying relevant amongst shoppers.

Key Takeaways

In summary, here are some of the key highlights of cashback in affiliate marketing:-

- Consumers’ acceptance of cashback is growing in Australia

- Cashback sites provide the opportunity for advertisers to reach new audiences

- Cashback is an effective way to incentivise consumers

- Cashback is now possible in both online and offline stores

Do you want to start working with cashback affiliates? Commission Factory can help.

Commission Factory is not only the Asia-Pacific region’s largest affiliate network, working with more than 800 of the world's biggest brands, but is also a performance marketing platform that allows content creators, affiliates and partners to earn money and retailers to increase sales.

Register as an Affiliate or an Advertiser today.

References

- 3 Tier Logic: 15 Impressive Customer Loyalty Statistics (2021)

- Harvard Business Review - Are You Undervaluing Your Customers?

- Incentive Solutions - Important Loyalty Program Statistics for 2020

- PRNewswire - Loyalty Programs Market to Reach $201 Billion by 2022, According to Beroe Inc.

- Cashback News - 20 Valuable Stats You Should Know About Loyalty Programs

- IAB Australia - Affiliate Marketing Australian Industry Review 2021

- Commission Factory: CPA increase vs paid placement