From fashion to electronics and even food, Malaysians have embraced online shopping with passion.

Malaysia's eCommerce market has never been stronger than in 2023. With growing internet penetration, and smarter, more powerful devices, consumers are increasingly flocking online to buy products and services. For advertisers and affiliate marketers targeting the country, an overview of Malaysia eCommerce statistics is essential to design an effective content strategy.

The Malaysian eCommerce market revenue is expected to reach $8.75 billion by the end of 2023 with a year-on-year growth of around 10%.1 with a projected growth rate of 13.26% over the next four years, the market volume in 2027 is expected to be around $14.40 billion.

At the same time, the number of online shoppers in Malaysia grew by 8.3% year-on-year, with 15.63 million buying consumer goods online at the start of 2023.2 The total estimated annual spend on eCommerce purchases in 2022 was $9.08 billion, spread across fashion ($2.73bn), electronics ($2.83bn), toys and hobbies ($1.11bn), personal care ($1.08bn), and food/beverages ($202mn).

And that's only the beginning. To understand the state of the Malaysian eCommerce market, here are the latest Malaysian online shopping statistics for 2024:

Table of contents:

- 4 Online Shopping Trends in Malaysia

- How Fast Is eCommerce Growing in Malaysia?

- Top 10 eCommerce Websites in Malaysia

- What’s Next for Malaysian eCommerce? (2024-2025)

- Malaysian Market Insight Report

- References

4 Online Shopping Trends in Malaysia

1. 60% of Internet Users Are Weekly Shoppers

Malaysia added 362,000 new digital consumers between 2022 and 2023. Amongst all the internet users, 9 out of 10 are now digital consumers. And 61.3% of Malaysian internet users purchase at least one product or service online every week.

This is on-trend with the rest of Southeast Asia. Singapore (61%), Indonesia (62.6%), Vietnam (60.76) and the Philippines (61%) all have the same percentage of active online shoppers, despite sharp differences in internet penetration levels.3

2. 9 in 10 Malaysians Are Active Internet Users

There were 33.03 million internet users in Malaysia in January 2023.2 This means Malaysia's internet penetration rate stood at 96.8% at the start of 2023. The year-on-year change in the number of internet users was +362,000, an increase of 1.1% since the beginning of 2022.

During the peak of the pandemic in 2021, Malaysians spent an average of over 9 hours and 17 minutes online across various devices and media.4 With the lifting of pandemic restrictions, this has dropped more than 12% to 8 hours and 6 minutes in 2023.2 However, daily internet usage is still higher than in pre-pandemic times.

Along with the pandemic, increasing internet speed has also helped drive eCommerce usage in Malaysia in recent years.

The median download speed in Malaysia stood at 98.48 Mbps for broadband and 62.92 Mbps for mobile internet in August 2023.5 This places Malaysia 39th and 34th in the world for broadband and mobile internet speeds respectively.

3. 77% of Consumers Remain Interested in eCommerce

The COVID-19 pandemic has led to a permanent shift in digital adoption and consumption in Malaysia. During the peak of lockdowns in 2021, 75% of Malaysians browsed an eCommerce platform, with 45% making a purchase. In 2022, the numbers remained largely static at 72% and 46% (PDF download).6

Only 23% of Malaysian eCommerce users intended to reduce their use of digital services in 2022-23.7 Around 53% planned to maintain their current usage patterns, while 24% intended to use online platforms more often for future purchases.

4. Smartphone Adoption in Malaysia Reached 90%

In 2022, Malaysia had a smartphone adoption rate of 90% (PDF download).8 The number is expected to reach 96% by the end of this decade.

There were 44.05 million cellular mobile connections in Malaysia at the start of 2023, compared to 42.11 million in the previous year.2 With a total population of 34.13 million, that translates into a mobile saturation level of 129.1%.

However, in terms of individual users, GSMA puts the subscriber penetration level in Malaysia at around 78%. This could increase to 85% by 2030 (PDF) at the current rates of growth.8

Considering that 54.7% of eCommerce transactions in Malaysia are completed on a mobile device, the increasing smartphone penetration means more people will choose to shop online.2

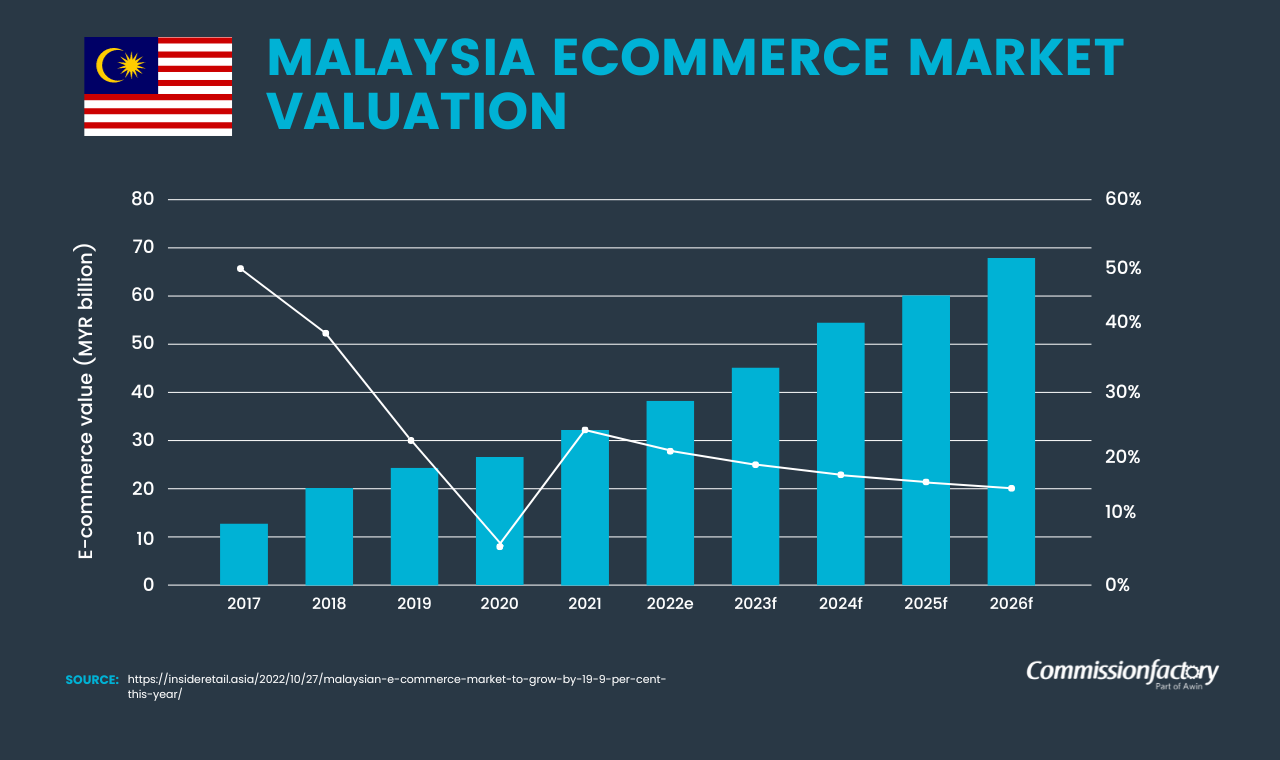

How Fast Is eCommerce Growing in Malaysia?

Malaysia's eCommerce Income Grew 6% in 2022

In 2021, Malaysia's overall eCommerce income passed the MYR1 trillion mark for the first time, growing by almost 22% over the previous year.9 Although growth has slowed since then, annual income still reached MYR1.09 trillion by the end of 2022, up 6% year on year.10

The sector witnessed even faster growth in the first half of 2023. Driven largely by improved performances in the manufacturing and services sectors, eCommerce income in the first quarter reached MYR291 billion, a 10% increase against the same period in 2022.

eCommerce’s contribution to Malaysia’s gross domestic product (GDP) is projected to increase from 11.6% in 2020 to 13% in 2021.11

COVID-19 Accelerated eCommerce Growth Remains Stable

eCommerce spending that exploded during the COVID-19 pandemic in 2020-21 has now become the norm in Malaysia.

The acceleration of eCommerce growth naturally followed the temporary closure of brick-and-mortar stores during lockdowns, with government incentives giving an extra push. Out of the total digital service consumers in Malaysia in 2020, 36% were new digital consumers.12

Pure-play retailers who solely sell online had witnessed a sharp spike in their revenues during lockdowns. Since 2022, many of these businesses in Malaysia have witnessed a drop of 50-80% as more customers venture out for basic needs such as food and beverages.13

However, despite these setbacks, major banks such as RHB and OCBC have reported no drop in eCommerce transaction volumes after the pandemic in Malaysia. RHB Bank reported a 49% increase in online spending post-pandemic.14

One 2022 survey found that 9 out of 10 Malaysians still prefer online shopping over traditional retail, and more than 50% have adopted it permanently.15

More Malaysians Bought Consumer Goods Online in 2022-23

The number of Malaysians buying consumer goods online increased by 1 million between 2022 and 2023.16 At 99%, Malaysia had the largest percentage of young online consumers (aged 15) among all ASEAN nations.

Online Consumer Goods Spending Jumped 5.9%

Malaysians spent $9.08 billion on consumer goods online in 2022, up $504 million year on year.2 However, the average annual revenue per online shopper for consumer goods fell 2.2% year on year to $581 from $594.

46% of Malaysians Made an Online Purchase in the Last Year

Nearly 46% of the population have bought consumer goods online in 2022.6 This is a marginal decline of 1.7% when compared to the pandemic years.

Nearly 61% of internet users make online purchases every week, including 28.7% who buy groceries, 13.2% who buy second items, and 12.1% who use a Buy Now Pay Later (BNPL) service.

Online Spending on Electronics Grew by 3.6%

Annual growth in online spending on electronics has fallen significantly from the pandemic levels of 36.5% to just 3.6% in 2023. However, Malaysians still splurged around $2.83 billion online on electronics.

Online Spending on Fashion Surged by 7.3%

Malaysians spent $2.73 billion on eCommerce fashion, up by $185 million or 7.3%. Although a far cry from the 49.5% growth witnessed in 2020, fashion remains a key driver for growth in Malaysian eCommerce.

Online Furniture Spending Declined by -0.6%

Furniture is one category that has witnessed a steady decline in online spending after the pandemic. Malaysians spent $736 million on furniture in online stores in 2022, which was down by $4.3 million compared to the previous year.

Online Spending on Toys, Hobby and DIY Grew by 8.5%

The eCommerce spending with the toys, hobby and DIY segment climbed by 8.5% year on year, or $87 million, to $1.11 billion in 2021.

Online Spending on Food Grew by 4.4%

Despite the removal of COVID-19 lockdowns, Malaysian consumers are still going online to buy groceries, with spending increasing by 4.4% to $158.4 million in food shopping online.

At the same time, online spending on beverages grew by 3.2% to $44.17 million - an increase of $1.4 million year on year.

Top 10 eCommerce Websites in Malaysia

Shopee led the Malaysian eCommerce market as the most clicked eCommerce site in the country, as of the second quarter of 2022.17

After major global platforms such as Google, Facebook, Whatsapp, and YouTube, Shopee received the most visitors from Malaysia in 2022 – a monthly average of 46.4 million total visits and 8.65 million unique visitors.

This is a decline from the previous year - the site witnessed total monthly visits of 56.2 million in the first quarter of 2021. Since the early days of eCommerce in the region, Singapore-based Shopee has been locked in a stiff battle for visitors with the Alibaba-owned eCommerce portal, Lazada.

However, as of September 2023, Shopee retains a commanding lead over Lazada with 42.8 million visits compared to the latter's 13.5 million monthly visitors.18 Other significant eCommerce portals with multi-million monthly visits include Carousell, AliExpress, and FoodPanda.

Despite reporting a 130% increase year on year in Malaysian cross-border sellers, Amazon is still nowhere in the top 20 list of eCommerce sites in Malaysia.19

What's Next for Malaysian eCommerce? (2024-2025)

The SEA region as a whole is an exciting market to watch in terms of eCommerce and growth for the coming decade. eCommerce in the region is heading into a new growth phase with a projected expansion of 15-25% over the next five years.20

While some observers speculated that eCommerce might contract after the pandemic, data shows this hasn't been the case.

Within the region, Malaysia will remain a key performer with an expected annual growth rate of 13.6% between 2023 and 2027.1 eCommerce payments in Malaysia are projected to increase from $22.23 billion in 2023 to $41.74 billion in 2027.21

In addition to the technological advances already discussed, such as growing mobile and internet penetration, this growth is being propelled by Malaysia's rising education levels and a consumption-driven middle class.

The World Bank Group has projected the country will become a high-income economy (PDF download) between 2024 and 2028.22

This is promising news for brands that are ready to make the move into the Malaysian eCommerce space and seize growth from this rapidly expanding market.

Malaysian Market Insight Report

Stats help create a much-needed big picture when it comes to Malaysia's eCommerce sector, an essential perspective for businesses looking to get ahead in one of the fastest-growing economies in the world.

At the same time, however, Malaysian shopping habits are constantly evolving in response to an array of cultural, technological and seasonal influences. Dig deeper into Malaysian consumer purchasing behaviour to understand the trends and future growth opportunities for brands in this unique and complex market.

Download our free 2023 Malaysian Market Insight Report

References

- eCommerce - Malaysia | Statista Market Forecast

- Digital 2023: Malaysia — DataReportal – Global Digital Insights

- Digital 2023: Global Overview Report — DataReportal – Global Digital Insights

- Digital in Malaysia: All the Statistics You Need in 2021 — DataReportal – Global Digital Insights

- Malaysia's Mobile and Broadband Internet Speeds - Speedtest Global Index

- eCommerce Landscape in a Reopened Economy | Ipsos

- e-Conomy SEA 2022 | Bain & Company

- The Mobile Economy Asia Pacific 2023 (gsma.com)

- Nation's eCommerce income surpasses RM1 trillion | The Star

- Income of e-commerce transactions surged in first quarter of 2023 | digitalnewsasia.com

- Malaysia: share of e-commerce to the GDP 2021 | Statista

- e-Conomy SEA 2020 Report.pdf | Bain & Company

- Online shopping still good post-pandemic | The Star

- Online Shopping Expected To Remain Popular Post-Pandemic | ringgitplus.com

- Shopee Survey: Nine Out Of Ten Malaysians Prefer Online Shopping Over Offline | Ringgitplus.com

- SYNC SEA Report | Bain & Company

- Malaysia: Leading e-commerce sites by monthly traffic 2022 | Statista

- Top Retail Websites in Malaysia - Top Rankings September 2023 | semrush.com

- Malaysian sellers on Amazon increases 130% yoy | The Malaysian Reserve

- E-commerce in Southeast Asia is entering a new phase | McKinsey

- Digital Payments - Malaysia | Statista Market Forecast

- Aiming High: Navigating the Next Stage of Malaysia’s Development | World Bank

%20(1000%20%C3%97%20250%20px)%20(1).png?width=1000&height=250&name=Banners%20for%20HubSpot%20(1000%20%C3%97%20500%20px)%20(1000%20%C3%97%20250%20px)%20(1).png)