Commission Factory and Awin Global share insights into the Australian market, local values, and technology.

On the 31 st of October, CEO and co-founder Zane McIntyre and Business Development Director of Awin APAC, Sophie Metcalfe presented our latest webinar, The Digital Revolution Down Under. The webinar content was originally presented at the Affiliate Summit APAC in Singapore.

In this first of a two-part blog series, we will look at what makes us Australians tick and the numbers behind the market.

Australian Values

As with any new market expansion, it is vitally important to understand the people and their values and customs. Australian culture is easy-going and laid back, therefore in a business setting, unsolicited calls and constant chasing is not seen too favourable by Australians. Australia has an outdoor culture, due to the beautiful landscape and all-round great weather, which can explain some of the trends we will later look at. It is important for us to have a good work-life balance and therefore sports and spending time outdoors play a huge part in our lives. We are also highly competitive, especially in a sporting capacity, to the point that sport is even seen as a religion to us and it can also mean that we can be bad losers.

Agriculture is exceptionally important to us; there is a respect for the land, as well as a focus on sustainability, although, the same cannot be said about some Australian politicians.

Fair-go is an official term and is part of the fabric of society which describes “fairness to all and every Australian is entitled to it”. We are big on relationships that translate into business and it is not uncommon that business is done over a beer.

Lastly, on values, Australians celebrate and support the local independent brands over large chains often “cheering the little guy over the big guy”, which has resulted in global brands struggling to launch in the Australian market such as Starbucks.

The Statistics

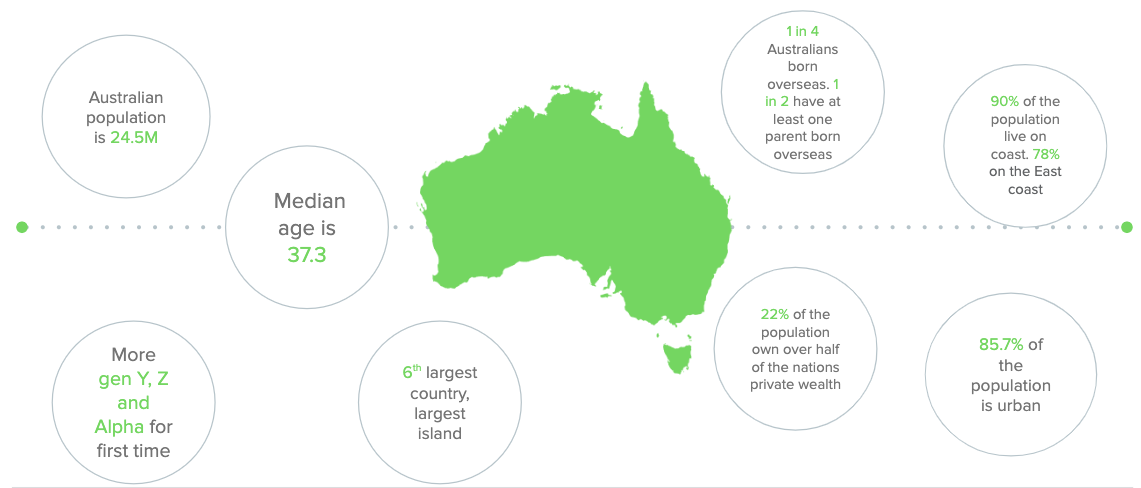

The Australian population is 24.5 million, with 90% (1) of those living on the coast and 78% of them living on the east coast, in five main cities, which makes the majority of the population urban. (2)

Historically Australia has had an ageing population, but for the first time in 2019, there are more Generation Y (born from 1980), Generation Z (born from 1995 to 2009) and Alpha (born since 2010), over half the population, which is significant on Australia’s GDP, which is currently causing a cultural shift. It has caused a change in every part of society, which some of the older generations have not been favourable towards Millennials. (3)

(Source 2. Worldometers - Australia Population)

Market Context

Digital Divide

Due to the vast size of the country, it is difficult to offer an infrastructure that provides a consistent internet offering. The current solution is National Broadband Network (NBN) and it is currently positioned as the best in the market. NBN is currently being rolled out across Australia, but it is not available everywhere and therefore the connectivity and type of access to the internet vary wildly depending on where in the country you live. This has resulted in a large portion of mobile-only households existing in Australia, although this number is decreasing with the introduction of the NBN. In short, the internet connection has a knock-on effect on internet usage and how people are shopping.

Independent Retailers

The value ‘Fair-Go’ and wanting to support the Underdog could explain why independent retailers in Australia are among the best performing in the world, second only to North America. The revenue from the independent sector is 18% above the global average. (4)

Technology such as cloud-based retail management solutions has enabled smaller local retailers to thrive. Also, with a focus on local independent businesses, it is one of the main contributors to the success of marketplaces. (5)

Early Adopters

Australia was the leading country on smartphone adoption during its rise ahead of the UK and US at its acceleration peak between 2011 - 1014 and has set us up for mobile-commerce and it remains one of the leading global adopters of the smartphone with 88% of Australians now owning one. (6) Although, not early adopters across all technological advancements, Australia is a global leader in fintech adoption particularly around mobile banking and bank app usage. It is predicted that mobile banking will completely replace internet banking in a few years’ time, which is specific to Australia as a market. (7) The early adoption of specific technology comes down to necessity and the fact the Australians like things to be easy.

Offline

There is still a lot of ad spend on outdoor advertising, as offline media is still highly consumed in contrast with the rest of the world, which is likely down to Australia being more an outdoors lifestyle and even pureplay retailers and some publishers are advertising offline. This means the marriage of online and offline strategies is important for targeting Australian consumers effectively. (8)

Payment Methods

Contactless payment

More Aussies than ever now use digital payment solutions, 14.5 million Australians aged 14+ (71.7%) use Digital Payment Solutions in a 12 month period. Apple has been reported to be twice as high as Google Pay. (9) The different forms of contactless payment can be found below.

- Apple Pay

- Samsung Pay

- Google pay (Android Pay)

- Fitbit pay

- PayWave/Paypass

Contactless technology called PayPass, PayWave or Contactless depending on what part of the world you are in, accounts for more than one in two face-to-face transactions under $100 are made using contactless technology, which is the highest in the world. (10)

Our society is becoming cashless, as well as increasingly becoming cardless. Most Australians under the age of 45 have never even seen an actual cheque, let alone written one. (9)

BPay

It is Australia’s most widely used bill payment service, which enables bill payers to transfer funds electronically from their bank accounts to billers.

Banking apps

All major banks have their own banking app, which allows payment to a mobile phone number and are in general well executed. Some banks even have their own payment splitting apps, allowing people to easily split their bills at a restaurant.

eWallet

eWallet is an electronic wallet that is preloaded with money that can be used online and offline through a computer or a smartphone whenever required. eWallets are available to Australians across the Apple, Android and Google, it is an example of how we love convenience, through consolidating, ease and simplicity, make it easier and faster to transact online and offline. (11)

Payment Gateways

Payment gateways are generally used by consumers who want peace of mind when shopping online, as it is a bridge between the consumer’s account and that of the retailer.

Paypal is still widely used, but in Australia, PayID has recently been introduced, which allows individuals to create a payment ID with their bank such as a mobile phone number, email address or if paying a business using their ABN and these details are used to pay you or make payment.

POLi is another option, which is owned by Australia Post, it is a trusted institution. This payment method is used more by the older generation, not widely used by the younger generation.

Artificial Intelligence (AI)

AI has been drawing a lot of attention recently and it is the buzzword in Australia and is currently being used in a number of ways by consumers.

We are adopting smart speakers such as Alexa, Google, Siri at a faster rate than the US with 5.7 million Australians owning a smarter speaker and about 1.35 million using these services to help navigate their daily lives and by the end of 2019. (12) It is predicted that 16% of Australian consumers will be using these services for end to end shopping. (13)

Chatbots are now used by most Australian utility companies as the first point of interaction with a client. They are the next stage of a phone system auto-receptionist. Australian businesses are adopting the technology quickly and even government agencies like the Australian Taxation Office are currently using chatbots. Gartner predicts in both Australia (and globally) that a quarter of customer service operations will involve chatbots or virtual customer assistants.

Purchase bundling

In terms of bundling, online retailers are combining the use of data and AI to increase basket sizes, giving consumers the option to add other items to their cart that are most often purchased together. This online technology of bundling is also allowing bricks and mortar retailers to assess and design the store layout, allowing them to add potential product add-ons to also increase basket value.

Drone Delivery

Australia was the first country in the world to test Google’s Project Wing drone delivery across North Canberra.

Drone Delivery is also being piloted by The Iconic, a local fast-fashion retailer and is being promised by Amazon to offer 30-minute delivery timeframes. There have however been noise complaints, so whilst the initial testing has been overall positive, there may be some regulation to come that will slow down adoption long term.

The Digital Revolution Down Under involves many moving parts that have shaped where we are today and what we do as digital marketers. It is important to understand the people’s values and in turn what drives Australian consumers and how they use technology. In the second roundup up we will be deep-diving into consumer trends and habits, as well as some of the questions that were asked on the webinar.

Sources | Part 1

- https://www.travelnation.co.uk/blog/10-interesting-facts-about-australia-that-may-surprise-you

- https://www.worldometers.info/world-population/australia-population

- https://mccrindle.com.au/insights/blog/top-6-trends-for-2019/

- https://insidesmallbusiness.com.au/featured/australias-independent-retail-sector-among-the-best-in-the-world

- https://www.kochiesbusinessbuilders.com.au/australias-independent-retailers-outperforming-the-rest-of-the-world/

- https://www2.deloitte.com/content/dam/Deloitte/au/Documents/technology-media-telecommunications/deloitte-au-tmt-mobile-consumer-survey-2017-211117.pdf

- https://mozo.com.au/fintech/apps-on-the-rise-the-future-of-mobile-banking-in-australia

- https://www.businessinsider.com.au/outdoor-advertising-market-australia-apn-outdoor-jcdecaux-oohmedia-2018-6

- http://www.roymorgan.com/findings/7587-the-way-australians-pay-is-changing-201806080637

- https://www.news.com.au/finance/money/contactless-tapandgo-payment-gains-popularity-with-australian-shoppers/news-story/3c1027e001df4b7f830c09963912f8d3

- https://www.feedough.com/e-wallet/

- https://voicebot.ai/2019/03/19/australia-leaps-past-u-s-in-smart-speaker-adoption-google-home-establishes-dominant-market-share/

- https://www.cpm-aus.com.au/key-trends-that-are-shaping-retail-in-2019